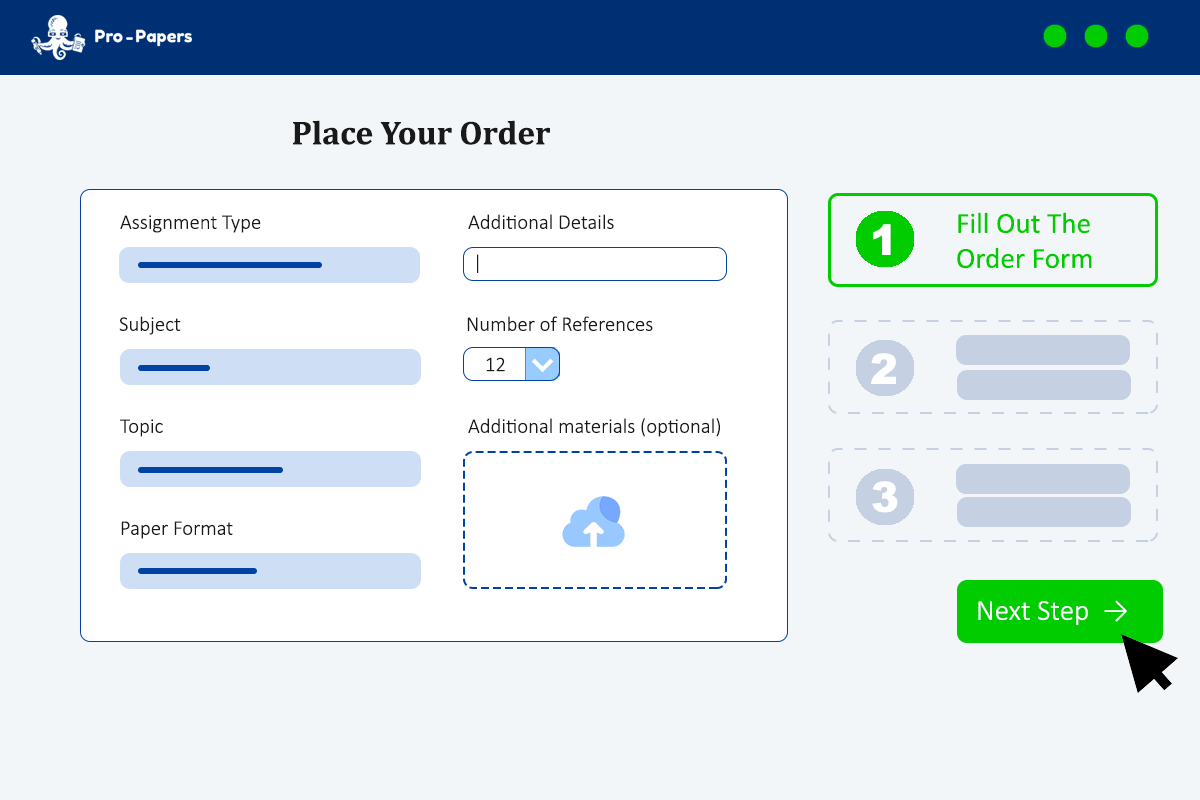

Learning to understand and solve accounting problems is a necessary skill for anyone who wants to be an accountant or a business professional. Such problems test your knowledge of a range of subjects, from simple accounting basics to harder areas like financial and managerial accounting. You're challenged to use accounting ideas in real-life business situations, accurately examine financial data, and make key decisions.

Let's improve your ability to understand and use accounting processes. Also, learn to excel at their use in real-life situations. Understand the structure of accounting questions. This is the first step. Master the basic principles of accounting secondly and then proceed to understand complex fields such as financial and managerial accounting.

Evaluate your capability to use theoretical accounting ideas accurately in real-life business scenarios. Polish your strategy and decision-making skills. Now apply what you understand to practical settings. You can do it!

The Importance and Types of Accounting Questions

Accounting, also known as the “language of business”, has been used since ancient times. The first evidence of accounting dates back to 3300 BC, when clay tokens in Mesopotamia were discovered, and they were used to record business transactions. However, its importance truly surged during the industrial revolution in the 19th century. This is when various types of accounting emerged. Today, the main types include financial, managerial, and tax accounting. Financial accounting focuses on reporting a company's financial information to external parties like investors. Managerial accounting provides information for internal decision-making. Tax accounting helps businesses follow the tax laws correctly. Diverse types of accounting questions have been developed to navigate these sectors efficiently. They often test one’s knowledge about concepts, principles, and rules to solve situations related to financial reporting, risk assessment, investment decisions, or tax liabilities.

Understanding the Importance of Accounting Questions

Knowing how to do accounting is crucial for a few key reasons. First off, accounting offers a clear view of a business's finances, which is essential for making informed decisions. It lets business owners see their company's financial strengths and weaknesses. accounting keeps you in line with legal tax requirements when you track income, expenses, and earnings. If you mess up your accounting, you may face legal troubles.

accounting helps with efficient operations by tracking when, where, and how money is spent. It shines a light on waste and can help point out ways to save money. accounting keeps a detailed record of past performance, which is crucial for planning and strategizing your company's future growth.

Last but not least, accounting is key for attracting investors. A well-kept accounting ledger can convince investors to commit because it clearly shows the company's financial status and potential for making a profit. To wrap it up, master accounting if you want to run a successful, compliant business. Please remember this.

Exploring Different Types of Accounting Questions

Accounting covers a wide range of subjects like financial, managerial, tax, and auditing issues. Questions about financial accounting often involve understanding and using accounting rules. For example, how to document transactions, create financial reports, and make sense of these reports.

Managerial accounting is more about strategic thinking. It is about using financial data to make choices that can impact the business' day-to-day activities. This may include analyzing costs, making budgets, and evaluating performance.

Tax accounting focuses on how tax laws apply to different financial events. Questions could be about tax preparation processes like calculating tax owed and navigating tricky tax codes.

Auditing questions usually look into both internal and external auditing procedures. Fairly common topics include how to carry out audits, making sure accounting practices are up to standard, and checking financial reports for correctness.

Even though these types of accounting questions are quite different in their focus, they all aim at one thing: ensuring financial transparency and accuracy in business. So make sure to understand and apply these principles and procedures correctly!

How to Solve Complex Accounting Questions

Accounting tasks may seem tough, but they're manageable if you break them down. Here's a simplified way to do that. Make sure to use this guide as your roadmap.

- Start by mastering basic accounting terms and rules such as assets, liabilities, equity, income, expenses, and how they are reflected in company's books.

- Read the problem you have to solve carefully. It could be about making financial reports, calculating financial ratios, or applying certain accounting rules. Spot the essential words and figures to know what you need to do.

- Organize the information given once you understand the problem. This could be on Excel or just a pen and paper. Turn the problem into a formula or form you can solve. For example, to find the net profit, deduct total costs from total income.

- While solving, stick to accounting rules. For example, always use the double-entry instruction where each operation affects at least two accounts. Also remember the accounting equation that Assets = Liabilities + Equity.

- Once you finish your working, double-check your solution. Review your calculations, ensure that you didn't skip any information, and confirm your solution stays true to accounting principles.

- Don't hesitate to ask for help if you're stuck. Accounting is complex, and you may need help from a workmate, tutor, or even online forums. A fresh perspective may point out errors you overlooked.

To sum it up, solving tough accounting tasks requires understanding the basics, keenly reading the problem, organizing your workings, remaining faithful to accounting rules, checking your work, and seeking help when you're stuck. Practice and you'll be able to tackle difficult accounting problems with ease.

To Wrap it All Up

Accounting is critical for a successful business. It builds financial security by carefully recording, observing, and analyzing all business transactions. Solving any accounting issues is vital. Doing so provides financial clarity, meets regulatory rules, ensures the use of money is responsible, and helps with wise decision-making. Rightly using accounting rules also lessens the chance of any financial errors. This gives everyone involved confidence in the company's financial well-being.

However, accounting can be complex and confusing. Solving these problems requires a good understanding of accounting rules and standards. Along with that, it requires strong critical thinking and analytical abilities. So, every accountant must keep learning and stay informed about any changes in regulations.

Start addressing any accounting issues fully. This strengthens the trustworthiness of financial reports and leads to a business's long-term success. Learn continually and keep up to date with regulatory changes. Use accounting principles correctly. Understand they can reduce the risk of financial mistakes. Know that accounting supports responsible financial management and wise decision-making. Grasp that resolving accounting issues is vital and strengthens financial reporting's integrity.